CHEERS project members to present at and co-organise the Scientific forum on Low Carbon Energy Innovation in Chengdu, China

This November, some of the members of the CHEERS consortium will co-organize the 10th Total China Scientific forum in Chengdu, China. This year’s forum, to be held on the 19-20th November, will explore topics related to Low Carbon Energy Innovation. With a focus on Low-carbon technologies, the Forum will serve as the perfect platform for CHEERS Consortium members to share their experiences and findings on the chemical-looping CO2 capture technology currently being developed in the project.

The Total China Scientific Forum (TCSF) is an international and open innovation platform which was created by Total in China, 2009. Each year, 150-200 key stakeholders from the academic community, industry, investment funds, governments, media and other groups meet to exchange latest developments in innovation and discuss opportunities and challenges within a specific domain.

A snapshot of one of the previous Total China Scientific Forums (Credit: TOTAL)

This year, the Forum will address topics such as the future of mobility, the role of gas and carbon capture and storage. Over 150 attendees will discuss China’s CCUS roadmap and, in the context of that topic, the developments within the CHEERS project.

Participants from the CHEERS consortium will include the Dongfang Boiler Company (DBC), Tsinghua university, representatives from Total and others. The Dongfang Electric Company, the parent company of DBC, has been invited to co-organize the event. Zheijang University will also participate in the Forum.

The TCSF will enhance the visibility of the CHEERS project, both locally in China and on an international level. The audience will include representatives from academy, industry representatives and managers, investment funds, policy makers and journalists.

CHEERS project members presenting on the 10th Trondheim Conference on CO2 Capture, Transport and Storage

This summer, the members of the CHEERS consortium will be presenting their findings on a leading scientific Carbon Capture and Storage (CCS) technology conference. The Conference will take place in Trondheim, Norway, on June 17–19 2019.

Since its inception in 2003, the bi-annual Trondheim CCS Conference has become a meeting point for leading researchers in the field of CCS. So far, over 400 experts coming from research and development institutions, universities and industry, have presented and discussed their work by participating in the Conference (click here for more information on the TCCS-10 conference). This year, these presentations will include various findings from the project partners of the CHEERS consortium.

‘’For many years we’ve been talking about CCS for CCS’s sake, which it is not. It’s about having clean energy, it’s about having a clean industry, it’s about having competitiveness and to have a decent handover of our planet to next generations’’ says Nils Rokke, the Executive Vice President of Sustainability at SINTEF.

CHEERS is a project which aims to achieve such goals by increasing the efficiency and decreasing the costs of the CLC capture technology. Finding more efficient ways of capturing CO2 emissions from industrial sources is an important part of achieving climate goals. A more energy and cost-efficient CLC technology will also help in reconciling the competitiveness of industries both in Europe and China with their respective climate goals.

CHEERS consortium partners have submitted 6 abstracts to this years’ 10th TCCS Conference. Along with a general overview of the CHEERS project, the consortium partners will present the developments related to several the development and demonstration of the CLC technology.

The work presented at the conference will include findings related to:

- Natural ore and novel perovskite oxygen carriers for chemical looping,

- Development of a demonstration unit by revamping an existing Circulating Fluidized Bed (CFB) pilot plant

- The mock-up experimental results of a 1.5 MW equivalent cold mock-up Chemical Looping Combustion unit.

The CHEERS (Chinese-European Emission-Reducing Solutions) project is financed by the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 764697 together with the Chinese Ministry of Science and Technology (MOST) and Chinese industry.

The CHEERS project: Strengthening and demonstrating EU-China cooperation on climate and research

On April 9th, the EU and China reaffirmed their commitment to strengthen their partnership in various areas, including climate related research and development. The CHEERS project is a good example of such close collaboration and knowledge-exchange between Chinese and European partners.

The 21st EU-China summit was held in Brussels, Belgium on April 2019. During the summit, European and Chinese leaders discussed mutually beneficial relations and a strengthening of their partnership.

The EU-China summit was held on the 9th April in Brussels, Belgium. Credit: European Commission

In a statement following the summit, the two parties concluded that they ‘’underline their strong commitment to implement the Paris Agreement and the Montreal Protocol’’. Given the urgency to respond to climate change, both the EU and China aim to ‘’further intensify their cooperation on the basis of the 2018 joint Leaders’ Statement on Climate Change and Clean Energy[1]’’. During the summit, both EU and Chinese delegations stated that they will reinforce ‘’their climate-related cooperation to advance the international climate negotiations process and in areas like carbon markets, long-term development strategies, clean energy and energy efficiency, low emission transport and cities’’[2],[3].

The CHEERS project is already a successful example of such cooperation. With 9 participating organisations both from the EU and China, it has contributed to research-related cooperation between the EU and China in the field of Carbon Capture and Storage. Over the past year, academics, research institutions and industrial partners of this consortium have authored a number of scientific publications presented at different international conferences.

The first phase of CHEERS consortium will finish by July 2019. A major achievement of this phase is design, construction and successful operation of a cold mock-up of the of the Chemical Looping Combustion technology with identical design as the demonstration plant.

The successful progress of CHEERS project will be a step toward clean industry, helping both EU and China reach their climate goals.

The CHEERS (Chinese-European Emission-Reducing Solutions) project is financed by the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 764697 together with the Chinese Ministry of Science and Technology (MOST) and Chinese industry.

[1] https://www.consilium.europa.eu/media/39020/euchina-joint-statement-9april2019.pdf

[2] https://cdn1-eeas.fpfis.tech.ec.europa.eu/cdn/farfuture/rVotT71TqcUuInsE7VOb7j1_xi9jIMcvhhHxcYLGE1g/mtime:1552379624/sites/eeas/files/factsheet_eu-china_03_2019.pdf

[3] http://eeas.europa.eu/archives/docs/china/docs/eu-china_2020_strategic_agenda_en.pdf

Press release: Promising results a year after kick-off of the CHEERS project

From 14 to 16 November, representatives of the CHEERS project consortium gathered at the second annual meeting held in Lyon, France. The updates shared during the meeting included key results from the first project phases and new developments presented by the partners of the consortium.

A year after the project set out to improve the efficacy of CO2 capture in industry, the project partners have achieved some promising results. The active collaboration of 9 partner organisations has resulted in a number of scientific publications, presentations at international conferences and most importantly, the design, construction and commissioning of a cold mock-up of the of the Chemical Looping Combustion technology.

The Cold Mock-Up with Representatives from the Core Design Team (representatives from Tsinghua University, IFPEN, TOTAL and Dongfang Boiler Co., picture taken at test site in Deyang)

To achieve its goal, CHEERS will test and verify a 2nd generation chemical-looping technology, starting at laboratory scale and then as a 3MWth system prototype for demonstration in an operational environment. The construction of the final demonstration unit is planned to be finalised by March 2021.

As its name suggests, the Chinese-European Emission-Reducing Solutions project aims to develop a chemical looping capture technology that will contribute to climate change mitigation in industrial applications. Finding more efficient ways of capturing CO2 emissions from industrial sources is an important part of achieving climate goals. Increasing capture efficiency directly reduces the energy requirements for a relevant climate change mitigation technology referred to in the newest IPCC report, carbon capture and storage. By making the technology more cost-efficient, the project will also help in reconciling the competitiveness of industries both in Europe and China with their respective climate goals.

With a budget of €16.8 million, the project is partially financed by the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 764697 together with the Chinese Ministry of Science and Technology (MOST) and Chinese industry.

What does a CLC testing facility look like?

The CHEERS project works on developing a chemical-looping technology tested at laboratory scale (up to 150 kWth). Within five years, the goal of the project is to develop the core technology into a 3MWth system prototype for demonstration in an operational environment.

That same CLC technology is being tested at SINTEF’s testing site in Tiller, Norway.

In the following videos, SINTEFs research scientists, Øyvind Langørgen and Inge Saanum, give a short rundown on what happens during the testing phase. Learn more about CLC and have a look at what a ”good day in the lab” looks like at the Tiller testing site:

”Welcome to the CLC rig at Tiller. Today we’re going to run a test campaign using copper oxide as oxygen carrier and methane as fuel gas.” says Øyvind Langørgen, research scientist at SINTEF Energy.

”The test is finished and we are very pleased with the results” says Inge Saanum, research scientist at SINTED Energy while going through the test results.

”This method is cheaper and requires less energy than many other methods” the video concludes.

CHEERS project members presenting at the 5th International Conference on Chemical Looping

Between 24-27 September, the members of the CHEERS consortium presented the findings and progress on their research at the International Conference on Chemical Looping in Park City, Utah.

Representatives from the Tsinghua University, IFPEN, Total and SINTEF discussed their research in presentations and panel discussions held at the conference.

The presentations included their findings concerning the modelling and experimental study, the pilot plant and other knowledge and results on oxygen/carbon carrier materials, reactor concepts, potential applications and emission controls.

In total, CHEERS consortium members contributed to the Utah conference with eight presentations.

Two of the presentations were given by IFPEN and TOTAL, four by Tsinghua University and two by SINTEF.

Attendees of the conference Image credit: University of Utah

Panel discussion with CHEERS consortium members Image credit: University of Utah

Accepted: members of CHEERS to present at international conferences

We are excited to announce that a number of abstracts submitted have been accepted for presentation at international conferences: the 5th International Conference on Chemical Looping (ICCL) which will be held 24-27th September in Park City, Utah, USA, and the 6th International Conference on CO2 Emission Control and Utilization (ICCU) which will be held 15-18th June in Hangzhou City, Zhejiang, China.

The ICCL is a premier international conference on chemical looping which has occurred every two years since 2010 when it was first held in Lyon, France. This year, the ICCL will meet between 24-27th September in Park City, Utah where the latest knowledge and results on oxygen/carbon carrier materials, reactor concepts, potential applications and emission controls will be presented.

Two abstracts from SINTEF, a member of the CHEERS project consortium have been accepted for presentation. The first, by Nils Erland Haugen (SINTEF) is a poster presentation on The CHEERS project: building a 3MW CLC-CCS system prototype plant for pet-coke, while the other is an oral presentation by Øyvind Langørgen (SINTEF) titled Chemical Looping Combustion of Biomass Pellets in a 150 kWth CLC Reactor.

In addition, four (4) abstracts from the Tsinghua University have been accepted for presentations at the ICCL. This includes:

(1) Oral presentation by Lei Liu from Tsinghua, titled The melting characteristics of ilmenites and manganese ores in chemical looping combustion.

(2) Oral presentation by Mao Cheng from Tsinghua, titled Coal-fired chemical-looping combustion coupled with a high efficient annular carbon stripper.

(3) Oral presentation by Ye Li from Tsinghua, titled Reaction kinetics analysis of char under conditions chemical looping with oxygen uncoupling.

(4) Oral presentation by Hu Chen from Tsinghua, titled Heat balance analysis of a 3 MWth pilot plant for CLC demonstration.

Two oral presentations will also be given at the 5th ICCL by members from IFPEN and TOTAL. Whereas Florent Guillou (IFPEN) will present on the CHEERS pilot plant, an original design dedicated to CLC efficiency, Airy Tilland (IFPEN) will present on Modelling and experimental study of a petcoke conversion with an oxygen carrier in a batch fluidized bed.

One abstract was also accepted for presentation at the 6th International Conference on CO2 Emission Control and Utilization (ICCU) which will be held 15-18th June in Hangzhou City, Zhejiang, China. The conference will gather lead researchers, engineers and officials interested in CO2 emission control issues to give presentations on variety of technology and policy-related topics. An oral presentation will be given by Zhenshan Li from Tsinghua University, titled CHEERS Project: Demonstration of CLC Technology in Semi-Industrial Scale via a Chinese – European Collaboration.

Following the completion of the presentations, these will be uploaded on to the CHEERS project website as part of knowledge dissemination.

Will changes to the US Budget Act of 2018 incentivise CCS?

CCS in the US has over the past decade or so been primarily linked to enhanced oil recovery (EOR) as its main driver. The recently passed Bipartisan Budget Act of 2018, however, includes a number of changes to the tax provisions which could prove to be a significant game changer for CCS developments in the US, by providing high-enough incentives for investments into CO2 capture and permanent storage.

Lack of financial incentives for permanent storage of CO2 has been one of the main inhibitants for CCS developments, in the US and elsewhere around the world. This has resulted in enhanced oil recovery (EOR) being the main driver for CCS developments in the US. The inclusion of the bill on Furthering carbon capture, Utilization, Technology, Underground storage, and Reduced Emissions Act (FUTURE Act) in the recently passed Bipartisan Budget Act of 2018 (hereinafter referred to as the Act), however, could result in an increased shift towards CO2 capture for permanent storage.

The changes

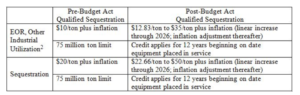

Essentially, the new Section 45Q, within the Act, increases the amount of the credit received, the time window for carbon capture projects, and the number of years to claim the credits. Before the passage of the Act, Section 45Q provided a $10 credit for each tonne of CO2 either used for EOR or other use, and $20 credit for permanent storage. The changes now provide for a tax credit, starting at $12.83 (for EOR) and $22.66 (for permanent storage) per tonne of CO2 in 2018, which is set to increase in a linear fashion to $35 and $50 per tonne of CO2 by end of 2026 respectively. After 2026, these amounts would be multiplied by inflation adjustment factor for a particular calendar year. In addition, whereas before, the amount of CO2 eligible for receiving credits was capped at 75 million tonnes, this has now essentially been removed, as it allows for receiving credits for any qualified facility for up to 12 years beginning on date the equipment is placed in service.

It is worth noting that the applicable new amounts of tax credits refer to the CO2 captured using equipment which was put in place on or after enactment of the Act. For the CO2 captured from facilities with CO2 equipment in place before the enactment of the Act, the old tax credit levels apply. However, in case qualified facilities which have been capturing CO2 before enactment of the Act install additional capture equipment, the total amount of CO2 captured is eligible for the higher tax credits. In addition, any facility which captures not less than 500,000 metric tonnes of CO2 during a year can be deemed, for the purposes of receiving tax credits, as having been in service on the date of the enactment of the Act.

Finally, the eligibility threshold for receiving the said tax credits has now been reduced from 500,000 to 100,000 tonnes of CO2 captured and stored on an annual basis. This change is particularly important as the higher threshold is believed to have prevented smaller industrial projects from using the tax credit incentives.

The table below shows some of the changes in tax credits brought about the new Act.

Table 1: The pre- and post-Act tax credits for EOR and geologic sequestration

It is worth noting that the captured CO2 that is eligible for receiving the credits applies to CO2 captured from power plants, industrial sources and direct air capture facilities. However, the CO2 used for EOR and natural gas recovery process that is then recaptured, recycled and re-injected as part of these processes is not eligible to receive these credits.

In 2014, 64% of the CO2 captured from industrial processes (mainly from ethanol, natural gas processing, ammonia production) and 91% of CO2 produced from natural sources was used for enhanced oil recovery. The remainder of the captured CO2 is also used in food and beverage manufacturing and/or pulp and paper manufacturing, fire-fighting equipment and metal fabrication. In addition, it is worth noting that in 2014 there was approximately 64 million metric tonnes of CO2 received for underground injection from close to 100 facilities, of which 63 million metric tonnes was intended for enhanced oil recovery.

Recognising CCS in the context of climate change and energy security have been the main drivers behind the new changes to the tax credit system, receiving wide support on both sides of the political spectrum in the US. In this respect, Senator Shelley Moore Capito (R-WV), notes that these changes will lead to the US becoming a leader in developing and exporting carbon capture systems. Senator Sheldon Whitehouse (D-RI) sees the expansion of 45Q tax credits as “…a big win for our climate and the promising new carbon capture and utilization technologies looking to gain a foothold in the market…[and] a key step forward in combatting climate change by putting a dollar value on reducing carbon pollution.”

In any case, it appears that the changes to the tax credit system described above are expected to provide both an increased certainty and incentive to potential project developers, thereby spurring development of carbon capture and storage in the US. Only time will tell, however, whether the proportion of CO2 intended for storage, as opposed to EOR, will increase.

Concerns remain

The captured CO2 has in the past, and is likely in the future to be used in EOR for shale oil production. This has raised questions on the implications this would have on the residual CO2 storage associated with EOR and the integrity of the geological structures. In this respect, the strict monitoring and reporting regulations are envisaged to mitigate the risk of any adverse events occurring.

Sources:

Bipartisan Budget Act of 2018, H.R.1892 C.F.R. (2018).

EPA. (2015). Capture, Supply, and Underground Injection of Carbon Dioxide. Retrieved from https://www.epa.gov/ghgreporting/capture-supply-and-underground-injection-carbon-dioxide

Heitkamp. (2018). Heitkamp, Capito, Whitehouse, Barrasso Announce Bipartisan Carbon Capture Technology Bill Signed in to Law. Available at: https://www.heitkamp.senate.gov/public/index.cfm/press-releases?ID=56B568EE-C05D-4DB1-B731-C343957AC83F

Hunton & Williams. (2018). Section 45Q Tax Credit Enhancements Could Boost CCS. Available at: https://www.huntonnickelreportblog.com/2018/02/section-45q-tax-credit-enhancements-could-boost-ccs/#_ftn2