The CHEERS project: Strengthening and demonstrating EU-China cooperation on climate and research

On April 9th, the EU and China reaffirmed their commitment to strengthen their partnership in various areas, including climate related research and development. The CHEERS project is a good example of such close collaboration and knowledge-exchange between Chinese and European partners.

The 21st EU-China summit was held in Brussels, Belgium on April 2019. During the summit, European and Chinese leaders discussed mutually beneficial relations and a strengthening of their partnership.

The EU-China summit was held on the 9th April in Brussels, Belgium. Credit: European Commission

In a statement following the summit, the two parties concluded that they ‘’underline their strong commitment to implement the Paris Agreement and the Montreal Protocol’’. Given the urgency to respond to climate change, both the EU and China aim to ‘’further intensify their cooperation on the basis of the 2018 joint Leaders’ Statement on Climate Change and Clean Energy[1]’’. During the summit, both EU and Chinese delegations stated that they will reinforce ‘’their climate-related cooperation to advance the international climate negotiations process and in areas like carbon markets, long-term development strategies, clean energy and energy efficiency, low emission transport and cities’’[2],[3].

The CHEERS project is already a successful example of such cooperation. With 9 participating organisations both from the EU and China, it has contributed to research-related cooperation between the EU and China in the field of Carbon Capture and Storage. Over the past year, academics, research institutions and industrial partners of this consortium have authored a number of scientific publications presented at different international conferences.

The first phase of CHEERS consortium will finish by July 2019. A major achievement of this phase is design, construction and successful operation of a cold mock-up of the of the Chemical Looping Combustion technology with identical design as the demonstration plant.

The successful progress of CHEERS project will be a step toward clean industry, helping both EU and China reach their climate goals.

The CHEERS (Chinese-European Emission-Reducing Solutions) project is financed by the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 764697 together with the Chinese Ministry of Science and Technology (MOST) and Chinese industry.

[1] https://www.consilium.europa.eu/media/39020/euchina-joint-statement-9april2019.pdf

[2] https://cdn1-eeas.fpfis.tech.ec.europa.eu/cdn/farfuture/rVotT71TqcUuInsE7VOb7j1_xi9jIMcvhhHxcYLGE1g/mtime:1552379624/sites/eeas/files/factsheet_eu-china_03_2019.pdf

[3] http://eeas.europa.eu/archives/docs/china/docs/eu-china_2020_strategic_agenda_en.pdf

What does a CLC testing facility look like?

The CHEERS project works on developing a chemical-looping technology tested at laboratory scale (up to 150 kWth). Within five years, the goal of the project is to develop the core technology into a 3MWth system prototype for demonstration in an operational environment.

That same CLC technology is being tested at SINTEF’s testing site in Tiller, Norway.

In the following videos, SINTEFs research scientists, Øyvind Langørgen and Inge Saanum, give a short rundown on what happens during the testing phase. Learn more about CLC and have a look at what a ”good day in the lab” looks like at the Tiller testing site:

”Welcome to the CLC rig at Tiller. Today we’re going to run a test campaign using copper oxide as oxygen carrier and methane as fuel gas.” says Øyvind Langørgen, research scientist at SINTEF Energy.

”The test is finished and we are very pleased with the results” says Inge Saanum, research scientist at SINTED Energy while going through the test results.

”This method is cheaper and requires less energy than many other methods” the video concludes.

Will changes to the US Budget Act of 2018 incentivise CCS?

CCS in the US has over the past decade or so been primarily linked to enhanced oil recovery (EOR) as its main driver. The recently passed Bipartisan Budget Act of 2018, however, includes a number of changes to the tax provisions which could prove to be a significant game changer for CCS developments in the US, by providing high-enough incentives for investments into CO2 capture and permanent storage.

Lack of financial incentives for permanent storage of CO2 has been one of the main inhibitants for CCS developments, in the US and elsewhere around the world. This has resulted in enhanced oil recovery (EOR) being the main driver for CCS developments in the US. The inclusion of the bill on Furthering carbon capture, Utilization, Technology, Underground storage, and Reduced Emissions Act (FUTURE Act) in the recently passed Bipartisan Budget Act of 2018 (hereinafter referred to as the Act), however, could result in an increased shift towards CO2 capture for permanent storage.

The changes

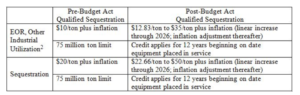

Essentially, the new Section 45Q, within the Act, increases the amount of the credit received, the time window for carbon capture projects, and the number of years to claim the credits. Before the passage of the Act, Section 45Q provided a $10 credit for each tonne of CO2 either used for EOR or other use, and $20 credit for permanent storage. The changes now provide for a tax credit, starting at $12.83 (for EOR) and $22.66 (for permanent storage) per tonne of CO2 in 2018, which is set to increase in a linear fashion to $35 and $50 per tonne of CO2 by end of 2026 respectively. After 2026, these amounts would be multiplied by inflation adjustment factor for a particular calendar year. In addition, whereas before, the amount of CO2 eligible for receiving credits was capped at 75 million tonnes, this has now essentially been removed, as it allows for receiving credits for any qualified facility for up to 12 years beginning on date the equipment is placed in service.

It is worth noting that the applicable new amounts of tax credits refer to the CO2 captured using equipment which was put in place on or after enactment of the Act. For the CO2 captured from facilities with CO2 equipment in place before the enactment of the Act, the old tax credit levels apply. However, in case qualified facilities which have been capturing CO2 before enactment of the Act install additional capture equipment, the total amount of CO2 captured is eligible for the higher tax credits. In addition, any facility which captures not less than 500,000 metric tonnes of CO2 during a year can be deemed, for the purposes of receiving tax credits, as having been in service on the date of the enactment of the Act.

Finally, the eligibility threshold for receiving the said tax credits has now been reduced from 500,000 to 100,000 tonnes of CO2 captured and stored on an annual basis. This change is particularly important as the higher threshold is believed to have prevented smaller industrial projects from using the tax credit incentives.

The table below shows some of the changes in tax credits brought about the new Act.

Table 1: The pre- and post-Act tax credits for EOR and geologic sequestration

It is worth noting that the captured CO2 that is eligible for receiving the credits applies to CO2 captured from power plants, industrial sources and direct air capture facilities. However, the CO2 used for EOR and natural gas recovery process that is then recaptured, recycled and re-injected as part of these processes is not eligible to receive these credits.

In 2014, 64% of the CO2 captured from industrial processes (mainly from ethanol, natural gas processing, ammonia production) and 91% of CO2 produced from natural sources was used for enhanced oil recovery. The remainder of the captured CO2 is also used in food and beverage manufacturing and/or pulp and paper manufacturing, fire-fighting equipment and metal fabrication. In addition, it is worth noting that in 2014 there was approximately 64 million metric tonnes of CO2 received for underground injection from close to 100 facilities, of which 63 million metric tonnes was intended for enhanced oil recovery.

Recognising CCS in the context of climate change and energy security have been the main drivers behind the new changes to the tax credit system, receiving wide support on both sides of the political spectrum in the US. In this respect, Senator Shelley Moore Capito (R-WV), notes that these changes will lead to the US becoming a leader in developing and exporting carbon capture systems. Senator Sheldon Whitehouse (D-RI) sees the expansion of 45Q tax credits as “…a big win for our climate and the promising new carbon capture and utilization technologies looking to gain a foothold in the market…[and] a key step forward in combatting climate change by putting a dollar value on reducing carbon pollution.”

In any case, it appears that the changes to the tax credit system described above are expected to provide both an increased certainty and incentive to potential project developers, thereby spurring development of carbon capture and storage in the US. Only time will tell, however, whether the proportion of CO2 intended for storage, as opposed to EOR, will increase.

Concerns remain

The captured CO2 has in the past, and is likely in the future to be used in EOR for shale oil production. This has raised questions on the implications this would have on the residual CO2 storage associated with EOR and the integrity of the geological structures. In this respect, the strict monitoring and reporting regulations are envisaged to mitigate the risk of any adverse events occurring.

Sources:

Bipartisan Budget Act of 2018, H.R.1892 C.F.R. (2018).

EPA. (2015). Capture, Supply, and Underground Injection of Carbon Dioxide. Retrieved from https://www.epa.gov/ghgreporting/capture-supply-and-underground-injection-carbon-dioxide

Heitkamp. (2018). Heitkamp, Capito, Whitehouse, Barrasso Announce Bipartisan Carbon Capture Technology Bill Signed in to Law. Available at: https://www.heitkamp.senate.gov/public/index.cfm/press-releases?ID=56B568EE-C05D-4DB1-B731-C343957AC83F

Hunton & Williams. (2018). Section 45Q Tax Credit Enhancements Could Boost CCS. Available at: https://www.huntonnickelreportblog.com/2018/02/section-45q-tax-credit-enhancements-could-boost-ccs/#_ftn2

The Role of Market Makers in the deployment of CCS

Bellona’s report shows that a stepwise roll-out of deep decarbonisation infrastructure, in the form of CO2 transport and CO2 storage infrastructure, can enable industrial emitters, employment unions and regional government engage constructively in creating a deeply decarbonised industrial base for Europe.

The presence of infrastructure to take CO2 away from sources and allow commercial disentanglement along the CO2 capture, transport and storage value chain will significantly reduce the commercial and organisational obstacles for CO2 capture at industrial sites. CO2 Market Makers (regional CO2 transport and storage infrastructure development organisations) are key in enabling the deployment of an effective CO2 network in order to reduce costs and risks of industrial deep decarbonisation.

Market Makers that enable deep decarbonisation of industry have come to prominence due to slow progress in deploying CO2 capture, transport and storage in Europe. The concept of planned and strategic development of CO2 infrastructure is not new. In 2005, the Bellona Foundation proposed elements of a CO2 Market Maker to increase CO2 use on the North Sea. In its November 2014 on Business Models for Commercial CO2 Transport and Storage, the Zero Emissions Platform (ZEP, the EU Technology Platform for CCS, in which Bellona plays a leading role) picked up that concept of CO2 Market Makers to progress CO2 storage deployment in line with European decarbonisation pathways.

Some key characteristics of Market Makers are that they address many of the structural market failures that retard CCS and the coordination barrier in them. Through providing a form of central planning Market Makers give certainty to a CO2 storage developer that CO2 will be captured and certainty to an industrial CO2 capture. Another characteristic is that they provide a degree of policy certainty to emitters of decarbonisation requirements and timelines. At the same time they can act if required to preserve useful retiring infrastructure, such as natural gas pipelines scheduled for decommissioning that are suitable for CO2 transport.

Bellona shaping the necessary EU regulatory framework for CCS deployment

In May 2015, in a meeting with European Commission Vice President Maroš Šefčovič, ZEP and Bellona presented this as a recommended way forward for the EU, resulting in the Vice President’s request for an ‘Executable Plan’ for enabling CCS in Europe. Bellona led the work with this plan, which was presented to the Commission in the summer of 2015. A follow-up was requested from the Commission that would identify some key strategic industrial regions for which a CO2 hubs-and-clusters approach would be particularly relevant. There are now encouraging signs that the Market Maker and CO2 hubs and clusters concepts are being picked up by CCS policy makers in various parts of Europe.

Especially encouraging is the recent news that the Norwegian government has approved funding of the FEED studies for three large-scale industrial CO2 capture projects (for cement, ammonia and waste incineration respectively) along with a shared transport and storage solution for the three. The preferred solution would be a ship terminal on the Norwegian west coast, connected with a pipeline to take CO2 to offshore storage. This would open for receiving CO2 from any emission source with access to shipping facilities. It is a solution which could benefit initial CO2 Market Makers across Europe and as such closely follows the abovementioned 2015 Bellona CO2 economy recommendations.

CO2 transport and storage benefit greatly from economies of scale – costs can be reduced quickly through scaling up and sharing of infrastructure between projects.